Bitcoin is an incredible opportunity to give yourself financial freedom, but it can be daunting. Ministry of Nodes is our effort to help everyday people start with Bitcoin and navigate this confusing space and crucially, avoid the common pitfalls that cost people money. We provide a pathway of practical and actionable steps to take, that will improve your financial self-sovereignty with Bitcoin and other technologies.

Why start with bitcoin now? You need skin in the game

You participate in Bitcoin by accumulating some and storing it, or setting up to receive payment in Bitcoin. It might seem confronting at first, but really the easiest way to learn more about it is to buy some and use it in practice. Using Bitcoin won’t be a choice in the longer term. It’s not going away. It is strictly limited, and there will never be more than 21 million in circulation. The world is repricing into Bitcoin and this will be a huge wealth transfer in favour of Bitcoin holders, so get ahead of it and learn now. We’ve written this guide to be as concise as possible to help you start.

Buy a small amount of Bitcoin

1 Bitcoin is divisible to 100 million satoshis (aka sats) – think of it like dollars and cents, where sats are the cents. So you can buy a fraction of bitcoin, say $200 worth or however much you’re comfortable starting with.

Sign up with a Bitcoin exchange or broker service and purchase a small amount to get started. Suggested options are:

- Swan Bitcoin (USA) – disclosure: Stephan is an advisor, holds a small equity stake and Swan are a sponsor of Stephan Livera Podcast

- River (USA)

- Cash App (USA)

- Relai.ch (Europe)

- Bitaroo (Australia)

- FastBitcoins (Australia)

- CoinFloor (UK)

- Bull Bitcoin (Canada)

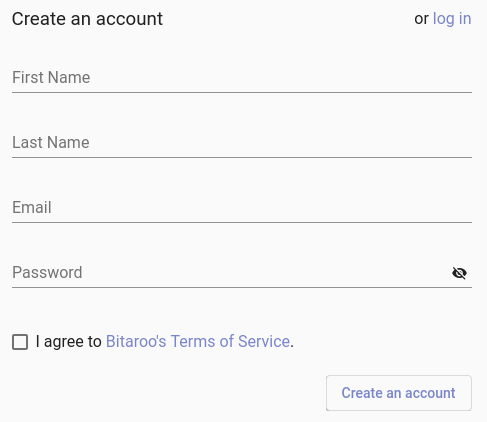

Note the process will differ across exchanges, but generally it will look like this:

Signing up for an account:

Verifying email (click the link in your email)

You will need to verify your identify through something called ‘Know Your Customer’ (KYC) process with your driver’s licence, passport or similar

Once you are verified, go to the Deposit screen, and deposit fiat (transfer your fiat USD/AUD/etc money to the specified account):

Purchase Bitcoin or set up an auto buy order (auto buys explained later in this guide):

So now we’ve purchased some sats, but we’re not done yet!

Don’t think of Bitcoin like you do a stock or a bond where you leave it on the brokerage terminal. Bitcoin is something that gives you incredible power if you are able to use it in a self-sovereign way where you control it. This protects you against debasement, or remote confiscation and keeps the power in your hands.

Now, it’s time to take self custody of your Bitcoin. Don’t worry, it’s been made simple and fast to start with bitcoin on a mobile wallet nowadays.

Set up a Bitcoin wallet on your phone

A good, free, beginner Bitcoin wallet is Muun Wallet. You can install this on your phone via Google Play or Apple Store. Create a Wallet, then go to ‘receive’ – and select the method to receive.

If you selected a Bitcoin address, it will show “bc1…” (or an equivalent QR code) and this is what you will copy/paste into your exchange or broker service’s withdraw function to receive your bitcoin into your Muun wallet.

Bitcoin can be received using what’s called “on chain payment”, or it can be received using the lightning network. Not all exchanges or broker services support lightning withdrawal yet. If you toggle over at the top to lightning, it will look like “lnbc…” or a QR code.

This is a lightning invoice which you can use to receive funds. Muun supports either method, so select the appropriate one in the ‘receive’ screen.

If you’re working with an exchange, find the withdraw page, then copy/paste your bitcoin address (bc1…), or your lightning invoice (lnbc…) into the exchange withdraw function, e.g. ‘Withdrawal address’ in the below form. Use lightning if your exchange supports it, as that’s faster and more practical for smaller values.

If you’re doing a trade in person, you can show them the QR code to scan and pay you. If you’re transacting in person, you will find lightning faster and more convenient, but you’ll have to make sure the other party has a lightning enabled bitcoin wallet. Otherwise you can fall back to taking the payment on chain.

Once you’ve received funds into your wallet, it will now look like so.

Backing up

Now that you’ve got your sats ‘on’ your phone, what would you do if you lost your phone? You might lose access to the Bitcoin you bought. However, in Bitcoin we can back up our coins and recover them using another device.

Muun wallet has a backup system which you should explore and execute in a private place with a pen and paper.

Set your email address, and write down the backup codes it gives you. Go through and follow the prompts.

Now that you’re backed up, if you lost your phone, you can recover your bitcoin with this backup file Muun stores in your cloud backup (Apple or Google) and your recovery code, or via email and password.

Keep this backup paper in a safe place.

So how do we use this thing?

Think of it like this – smaller day to day payments will be done using lightning, while bigger payments will be done using Bitcoin on-chain payments. The cool thing is, Muun supports both, and if you’d like to experience the magic of your first bitcoin/lightning transaction, you can test out a lightning payment to donate $1 (or however much) to our tipjar here:

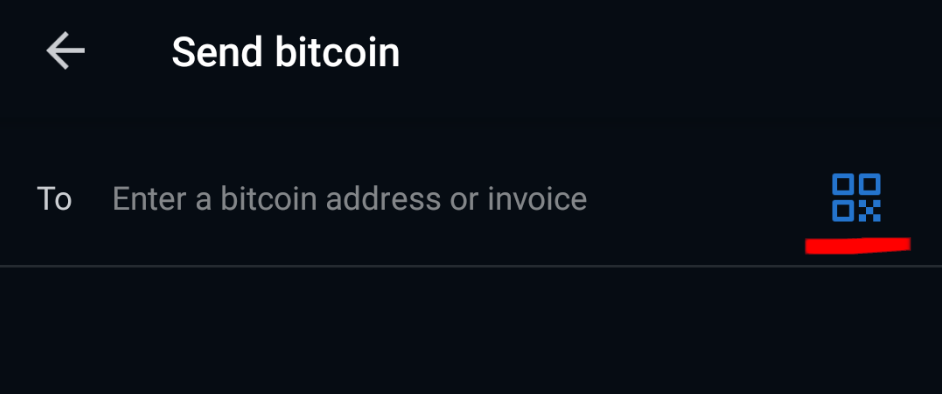

To do this, enter the amount you’d like to tip and click pay. Our site will then show you a QR code. Open your Muun wallet, click send, enable camera, then tap the QR icon (shown below) to bring up your scanner.

Scan the QR on the site, and Muun will show you a confirmation screen. Click pay and it will make the payment. Congratulations! The first Bitcoin payment is always a magical experience.

If you’re thinking, “Where can I spend on products and services?”, check out bitrefill.com as an example of vouchers for many products you already know (fuel, groceries, electronics etc), which you can buy using bitcoin over the lightning network.

Proceed on your journey of learning Bitcoin

To start with Bitcoin the right way, here are some suggested resources for learning:

- If you’d like a curated track of resources, check out the free, online Saylor Academy Bitcoin for Everybody course, which I (Stephan Livera) designed.

- Start listening to podcasts, such as Stephan Livera Podcast, Tales from the Crypt, or What Bitcoin Did.

- Some recommended Bitcoin books:

- Bitcoin Money (designed for kids, but useful for adults also)

- The Little Bitcoin Book

- Inventing Bitcoin (get this free here by Swan Bitcoin)

- The Bitcoin Standard

- Why Buy Bitcoin (financial advisor and investment perspective)

- Layered Money

- 21 Lessons

- Grokking Bitcoin (more technical)

- The Blocksize War

- Follow us on Bitcoin Twitter to stay up to date on the latest discussions.

- Subscribe to our YouTube channel

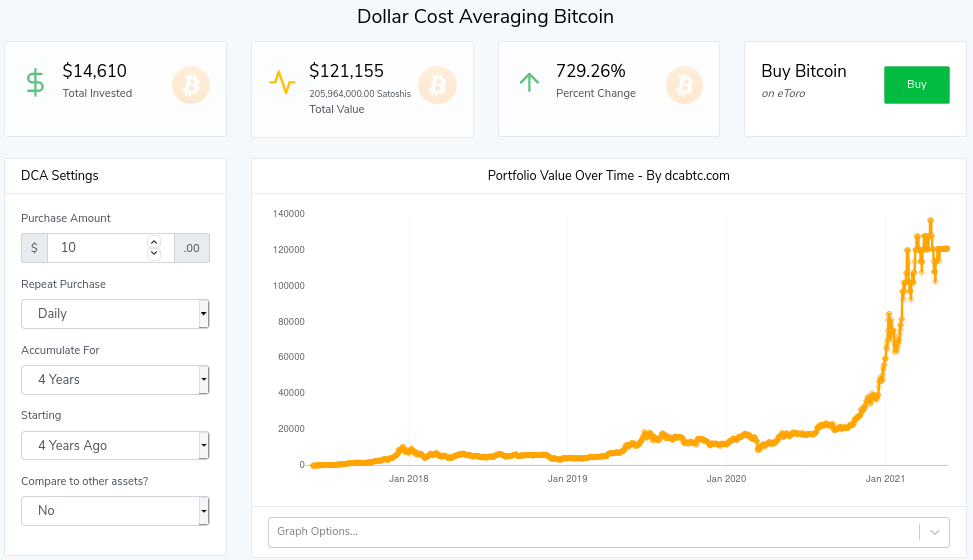

Set up your Auto-Buy or DCA plan

If you’ve just started with a small buy, make sure you follow that up with an automated dollar cost averaging plan. Pay yourself first! If you look at resources, such as dcabtc.com, strategy.com, or casebitcoin.com you will see that the average return over the longer term on Bitcoin is in the range of 130%/year, so buying and holding for the long term has historically been very successful. But don’t treat this like a get rich quick scheme! In your mind, you should be thinking of holding most (or all) of those sats for a minimum period of 4 years.

The goal is to become a strong hand HODLer who thinks long term and plays the long game on the path of Bitcoin going to $10M+. If you get too emotionally invested and sell because of some random negative news story you heard on Bloomberg, you risk missing out on a massive wealth transfer!

When #Bitcoin dips pic.twitter.com/SncdOp9dwq

— Lina Seiche (@LinaSeiche) April 23, 2021

Set up an auto-buy or DCA for what you can comfortably HODL. If you’re anything like us you’ll find that you increase your investment or DCA amount as your knowledge and conviction grows.

What kind of results do you get from a Bitcoin DCA?

See below a simple example from dcabtc.com (run on 25/5/2021) – stacking $10 daily for 4 years got you over 700% return on your investment:

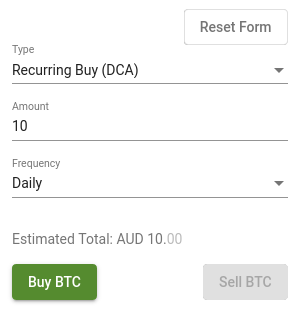

How do you set up a Bitcoin DCA?

Say for example you cut your expenses, and you want to buy $300 of Bitcoin per month, you can think of it this way:

- Divide $300 by 30 = $10/day

- Deposit $300 from your fiat bank account into the exchange

- Set up an Auto DCA Order for $10/day

- At the end of the month, withdraw the Bitcoin to your Muun wallet

- Rinse and repeat

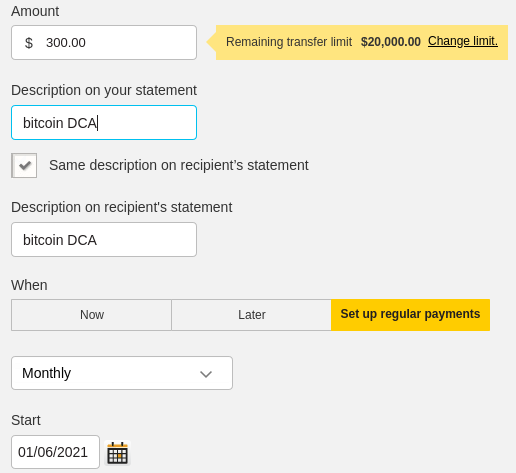

Taking Bitaroo as an Australian example, you can see this below:

Other exchanges or services like Swan Bitcoin (US) or Relai.ch (Europe) are explicitly set up for DCA aka auto-stacking. And of course, you can vary your monthly amount based on how much you’re able to save into Bitcoin for the long term.

To automate the fiat side, most bank websites have an ability to create a regular payment/transfer. Here’s what it looks like as an example.

This DCA method is a great start with bitcoin because it helps ease you in and Bitcoin’s volatility won’t be so harsh. To properly automate it, you can also automate pushing the $300 (in this example) from your bank website to the exchange with a recurring transfer.

What’s the pathway forward?

So in Bitcoin, we have various mantras and ideas to learn. But for now, keep in mind these 2 ideas:

- Not your keys, not your coins

- Not your node, not your rules

So we’ve already sent you down the pathway of holding your own private keys, which is what it means to hold your own coins on your mobile wallet. Using Muun wallet is a great start with Bitcoin, but as the value in your wallet grows, you should improve your level of security.

Your future steps will be to learn to use a hardware wallet, run your own bitcoin node, and eventually, upgrade to multi-signature for the best security. Check out the next steps which will be posted on our site shortly.

If you need assistance, we offer paid Zoom consults on our consulting page. E-mail us at [email protected] for any queries.

.png)